Low gold prices with the decline in geopolitical and commercial tensions, where is the market heading?

Low gold prices

Gold temporarily loses its luster with the improvement of trade relations and indicators of political stability

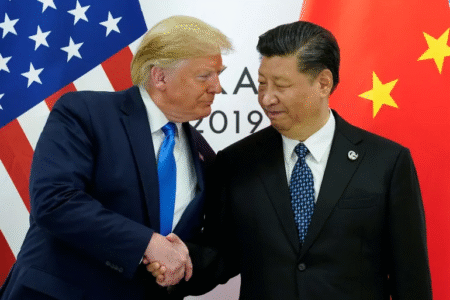

I witnessed Global gold markets are remarkable During the trading of Monday, May 12, 2025, affected by the decline in geopolitical fears and the progress of trade negotiations between the United States and China, which reduced the demand for precious metal as a safe haven. The price of gold has decreased by a rate of reaching 1.8% during early Asian transactionsTo settle near the level $ 3,265 an ounceAfter he had recorded weekly gains by 2.6% earlier.

Positive commercial talks between Washington and Beijing led to a decrease in gold prices

The main motivation behind this decline was Positive signs issued by US -Chinese trade negotiationsAnd that was held in Switzerland for two days, during which Washington and Beijing announced “great progress”, which strengthened optimism by the possibility of ending trade tensions between the two largest economies in the world.

Although the tangible measures are not announced so far, the positive atmosphere raised the price of the US dollar, which made gold The most expensive for global buyersAnd reduce the demand for purchase as a hedge origin.

The dollar ascends … and the low gold prices

Gold prices usually move in reverse with the value of the dollar.

With The Bloomberg index of the dollar increased by 0.1%The purchase of gold has become less attractive, especially for investors in emerging markets who rely on weaker local currencies,

Which increased sales pressure on the yellow metal.

Support and Resistance levels: Does gold reach $ 3,100?

Nick Todel, chief analyst at AT Global Markets in Sydney, believes that the market needs to see Tangible details about the commercial agreement The expected, for investors to estimate the possible decline.

He adds that the first level to be monitored is $ 3,100 an ounce,

Warning that any additional decline in safe haven flows may push gold towards this level.

As for Robert Rene, Head of the Commodity and Carbon Research Department at Wespac Bank Corp,

He sees that gold is still moving inside A stable range ranges between 3,200 and 3,400 dollars,

But he warns that any decrease below 3,200 dollars may be a sign of a change in the general direction, although he sees that this region will be Backed well Thanks to the central demand and speculation.

A gradual withdrawal for hedge boxes

Big investors began to move their leaves.

According to the data of the “Related Request Committee for Commodities”, it was established Hedge boxes by reducing their upward bets Gold to its lowest levels in more than a year,

In reference to the decline in temporary confidence in the continuation of the wave of altitudes that the metal witnessed this year.

Gold is still 25% since the beginning of the year

Despite this recent decline, gold still maintains strong annual gains, as it recorded Up to 25% since the beginning of 2025Backed by several factors that included:

- Strong demand from central banksEspecially in China and India.

- Anxiety in global economic slowdown Due to protective policies.

- Geopolitical tensionsEspecially between Russia, Ukraine, India and Pakistan.

- Global inflationWhich has strengthened the demand for gold as a tool for cottling.

Last April, he recorded gold A standard level of $ 3,500 an ounceBefore gradually declining in recent weeks due to international variables.

Geopolitical tensions calm and low gold prices … temporarily

The decline in gold prices also came with Low severity of geopolitical tensions,

The ceasefire seemed between India and Pakistan are still steadfast Until Sunday, the fears of the outbreak of confrontation

Military between the two nuclear countries.

In the same context, the administration of US President Donald Trump is seeking to Settlement of the conflict in Ukraine,

Where Ukrainian President Foludmir Zellinski called his Russian counterpart Vladimir Putin to A direct meeting this weekWhich raised hopes that a political penetration can be made on this axis as well.

Factors may support gold again

Despite the current indicators of the decline, many analysts warn that the market is still Fragile and vulnerable to fluctuationsAnd that any relapse in commercial conversations or renewed in geopolitical tensions,

It can The bullish momentum returns to gold prices.

As well Interest policies In the United States, it plays a major role in determining the direction of the market.

As inflationary pressures continue, the Federal Reserve may deliberate Keeping interest rates high,

What may weaken gold, while any indication of the use of interest will re -ignite the demand for gold.

Is the gold rise season ended?

It seems that Gold entered a healthy correction stage After successive heights. Optimistic about the American -Chinese trade talks, and the decline in geopolitical risks, led to Decreased appetite for investors towards gold as a safe haven.

However, the market is still under strict control by investors, who They are waiting for clearer signals from central banks and political leaders In the coming days.

Currently, it remains 3,100 levels to 3,200 dollars per ounce Main support areas must be carefully monitored,

Especially with the intersection of global economic and political indicators.

Do we witness a bullish bounce soon? Or did gold began a declining journey that may continue for months?