Gold towards $ 6000? GB Morgan expectations open the door for a new future

Gold towards $ 6000?

At a time when global political and economic crises increase, he returned gold To top the scene as a safe haven that reflects the investor’s concern and their desire to protect their wealth from market fluctuations.

In this context, a bank surprised GB Morgan The global economic circles with ambitious expectations indicating the possibility of gold prices to rise to $ 6000 an ounce During the next few years,

On condition that a specific scenario is achieved, it may reshape the balance of investment assets in the world.

Gold towards $ 6000, where did these expectations come from?

The remarkable expectation came on the tongue Natasha KanifaThe largest commodity strategy in the bank,

Which made it clear in a note addressed to customers that there A possible strategic shift In the way institutional investors deal with Dollar The American as a traditional safe haven.

This transformation, according to Canviva, may push part of these investments to gold, which will be created Purter On the precious metal.

She added that a simple re -direction – Only 0.5% of foreign assets from the American market to gold – It may be sufficient to make a huge prices.

And she continued: “Gold currently only 4% of the mix of global assets,

This means that any small amendment to the investment distribution can make a huge impact due to the limited global supply.

Current performance: rapid rise and increasing confidence

Since the beginning of 2025, gold has risen about 26% yet,

Driven by a number of global factors, most notably geopolitical tensions, the imposition of new American customs duties, and the escalation of commercial conflicts.

These events were raised from the appetite of investors to acquire gold as a hedging tool in an unstable environment.

Last April, gold recorded a historic leap by bypassing a barrier $ 3500 an ounce For the first time in its history, it is a record number that reflects the radical transformations in market behavior.

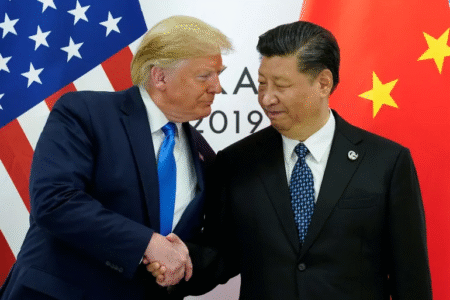

This rise came in conjunction with the announcement of former US President Donald Trump On April 2 on the imposition Comprehensive customs dutiesWhich increased the global commercial atmosphere and launched a new wave of gold demand.

Gold in the eye of the geopolitical storm – gold about $ 6000?

It is noticeable that gold is no longer seen only as a tool for financial rituals, but rather it represents A long -term strategic haven In light of the deep global changes.

According to multiple reports, central banks around the world – especially in Asia and the Middle East – She increased her gold reserves significantly In the last two years,

In an attempt to break the relative link to the US dollar, and achieve a balance in its reserve baskets.

In addition, the growing tensions in regions such as the Middle East, eastern Europe, and the South China Sea,

Increased Geopolitical anxiety ratesWhich led to an increase in capital flows to gold and moved away from the most volatile assets such as stocks and digital currencies.

What distinguishes the 6000 dollar scenario?

Financial institutions collect that reaching $ 6000 an ounce is not easy, but at the same time, it is at the same time It is not impossible. This depends, according to “GB Morgan”, on the acceleration of global economic transformations, such as:

- Loss of confidence in the US dollar As a single backup currency.

- Central banks continue to diversify their reserves By pumping investments in gold.

- Decreased performance of traditional financial markets In light of inflation or economic recession.

- Political and military tensions escalate In vital areas around the world.

According to Natasha Kaneva, it is not only related to immediate price movements, but with a long -term path based on Structural transformations In the way investors view the risks and reserves.

Are there indications that confirm this trend?

Undoubtedly, there are clear indications that the world is in the process of reshaping the global financial system. For example,

Russia and China have repeatedly declared their endeavor to break down the dollar, enhance the role of local currencies and gold in their commercial dealings. Also, a number of countries started By buying gold in unprecedented quantities In recent years,

As a way to protect itself from geopolitical tensions and economic sanctions.

Recent data from the International Monetary Fund also showed,

The percentage of gold reserves in central banks has increased to the highest levels in 30 years,

This reflects The slow but clear turning towards gold As a strategic origin.

In Lebanon and the Arab world .. What are the possible implications?

If this scenario is achieved, countries suffer from It deteriorated in its local currency like Lebanon You may find itself in front of a golden opportunity to enhance its reserves or protect the savings of its citizens through gold.

The rise in the price of gold means that individuals who own gold today – whether navy or savings – will witness a significant increase in its value,

This may be represented Economic safety network Amid the lack of confidence in the banking sector.

The governments in the region may encourage thinking strategically about how to manage their gold reserves,

And take advantage of the high prices in the future if these expectations are confirmed.

Gold towards $ 6000 ??

In a world where you are increasing Doubts, crises, and sudden transformations,

Gold seems to return to the forefront as an old goalkeeper in a rapidly changed world.

GB Morgan expectations to reach gold $ 6000 an ounce is not just random numbers,

Rather, it reflects a vision based on market data and behaviors.

Although the road is still long, the general trend indicates that gold will remain a major player in the equation of global financial stability,

And that those who bet on it today may be among the great winners tomorrow.